Want to Stand Out From the Herd? Ditch Commodity Content for Proprietary Research

The author’s views are entirely their own (excluding the unlikely event of hypnosis) and may not always reflect the views of Moz.

The launch of ChatGPT flooded the market with AI-generated content. However, AI lacks the spark of originality and those killer insights that turn your audience into loyal buyers.

Want to break away from the pack? It’s time to level up to proprietary research reports that serve as magnets for high-intent leads.

In this article, I will show you how to create proprietary research reports that power your content strategy and drive growth.

AI turns content into a cookie-cutter mess

It’s common to find SERP after SERP filled with near-identical content because AI tools spit out content faster than you can say “cha-ching.”

As AI churns out indistinguishable content at scale, it’s creating a glut of mediocrity. We’re talking about a sea of articles that parrot each other, often leaning on stale data and worn-out industry clichés.

Every company’s got its hands on these AI tools, and the more lookalike content they produce, the quicker they race to the bottom. You’re no longer competing on quality, but who can churn out content the fastest.

So, what’s the play?

Zig when everyone zags. Here’s what you need to do:

Be different: Stop chasing the same topics everyone else is writing about. Instead, dive into your data for unique angles.

Get proprietary: Use original research, product, or customer data to find fresh topics that capture audience interest.

Fuel your teams: Leverage this unique data to empower your internal teams with demand-generating content.

Why original research is the fuel for high-impact content strategy

1. Invest in one report to fuel your content calendar for months

Research reports require a higher level of investment, but one report can act as the cornerstone piece for two to three quarters. It depends on how much data you have, either from the published report or the data points that never made it into the live report.

You can repurpose a report into:

-

Social media posts

-

Podcast episodes

-

Webinar topics

-

Email sequences to nurture cold leads

-

Cluster of blog posts

-

Ideas for guest posting on industry publications

-

Potential topics for pitching live events

2. Build relationships with peers and customers

Use the report to collaborate with industry peers and internal experts during creation and promotion. It opens doors to partner marketing and influencer engagements.

Jeff Sirkin, CEO of Sirkin Research, advocates for a strategy he calls “The Trojan Horse Method”:

“The idea is to use your ideal customers and the people in your database.” says Sirkin. “When you use them as the survey audience, you get opinions from the people whose opinions matter most. And when you create the content, they’re suddenly interested because it’s about them. It’s about the biggest challenges they face related to your product.”

This approach deepens your relationship with your audience, which helps with brand loyalty.

3. Become the thought leader your industry needs

Think McKinsey or Gartner, and your mind immediately goes to their groundbreaking reports. Why? They dig deep, spot trends, and transform them into actionable insights. They’ve become the go-to authorities because they offer value that cuts through the noise.

You should aim to do the same. Make your brand synonymous with an idea or solution that resonates with your audience.

For example, the Content Marketing Institute produces annual Benchmarks, Budgets, and Trends reports across multiple sectors. Over time, these reports positioned them as the leading resource for content marketing trends.

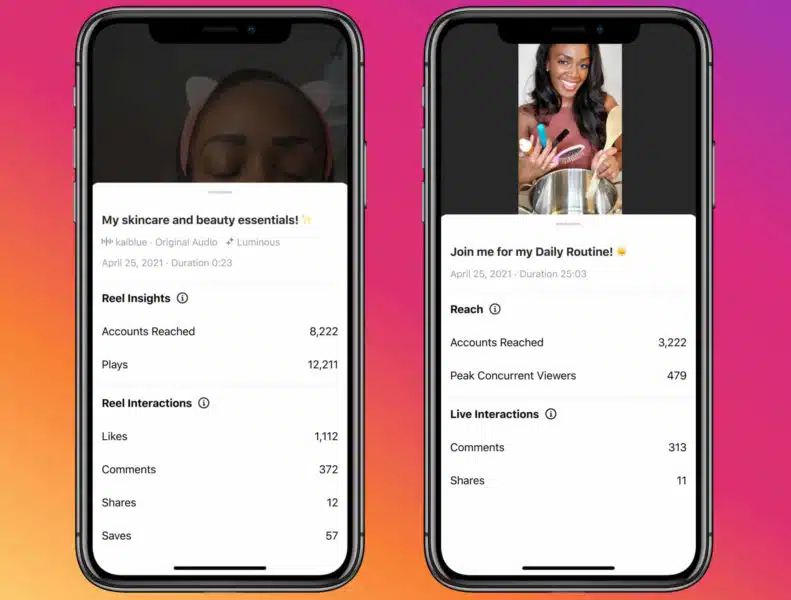

An example of an annual report that CMI produces each year

4. Create content that acts as a link magnet

Search engines love fresh content. And what’s fresher than a hot off-the-press research report? A comprehensive research report becomes a primary source others want to reference, earning you valuable backlinks.

For example, Andy Crestodina, CEO of Orbit Media, has conducted an annual blogging survey for the past ten years to identify the biggest trends and challenges in the industry. The survey helps Orbit Media earn tons of backlinks annually.

Orbit Media’s annual blogging survey has attracted over 13,000 links from 3,700 unique domains as of October 2023

Backlinks show search engine bots that you’re an authority on a specific topic while attracting more engagement and shares from humans.

5. Generate high-intent leads

A Demand Gen report found that 45% of B2B executives rely on research reports during their purchase journey. Potential customers want access to research that addresses pressing industry questions or reveals new insights. You can gate your reports with a contact form to get more segmented leads.

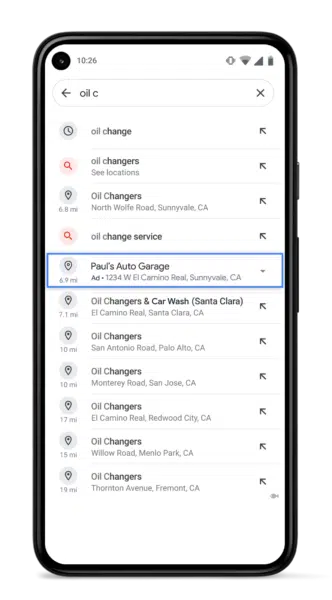

An example of qualifying fields that you can include in your contact form

6. Earn media mentions

Journalists love data and the opportunity to turn it into a story. A recent report found that 63% of journalists want to receive research reports from brands and PR professionals.

A journalist would likely pick up your published report if it offers fresh data on a popular topic or a unique take on existing research. Each media mention enhances your credibility and leads to more site visitors and sales opportunities.

12 tips to help you create your first research report

1. Survey internal teams to identify focus topics

Many companies think they need to publish reports that only speak to larger industry trends. But that doesn’t always work unless you’re an established company with significant brand awareness.

Victoria Gamlen, head of marketing at Sirkin Research, says your report should drive demand in the short and long term. To do that, you need to get a lay of the land. Talk to teams across the go-to-market function like:

-

Executive team

-

Marketing

-

Sales

-

Product

-

Customer Success

Gamlen’s team calls this process “organizational therapy,” where they conduct competitor analysis to assess what’s out there and devise hypotheses on topics that matter. The only way they can do that is by understanding the business and product/service first and identifying the following:

-

Top customer concerns

-

Larger industry shifts

-

Trends within your customer base

This input can help identify gaps in current knowledge and guide the focus of the research, ensuring that the final content is both relevant and impactful.

2. Master survey design

Sirkin mentions two extremes when creating original reports; they’re either too broad or too product/service-focused, and neither offer any value to the buyer.

The survey’s structure, flow, and question types (multiple choice, open-ended, etc.) should align with survey design practices. Ask the right questions, not just questions you want the answers to.

Michele Linn, founder of Mantis Research, a survey-based research firm, recommends the following as a starting point when designing the survey questionnaire:

-

Identify a statistic you want your brand to own

-

Identify missed opportunities in your space

-

Uncover any gaps you wish to address

-

Decide if you’re going to compare segments

3. Keep confirmation bias in check

Conducting research is about testing hypotheses, not validating preconceptions. You’re seeking insights, not affirmations. If you let the data guide the story rather than trying to fit the data into a predefined narrative, you’ll get better results.

Gamlen adds, “The whole point of demand research isn’t to prove something right or wrong. We’re here to get clarity on what’s most important to your ideal customers. If you prove something wrong, it means you’re proving something else right. This means you have a solid base to drive results while saving time and resources.”

4. Dial into the right audience for genuine insights

Your survey responses should come from topical experts. Since it’s a representative sample, clean the data to weed out unqualified responses.

This might mean excluding responses from individuals outside your target demographic or refining your dataset to represent a balanced cross-section of your audience. Conducting audience research is a vital part of this process.

Nneka Otika, a freelance content marketer, started with audience research when creating the State of the Administrative Industry report for Office Otter:

“I looked at what had been covered research-wise in the industry and discovered that we only covered salaries,” says Otika. “So, I decided to go with a state of industry report, which gave room to look at topic areas that my audience was already having issues with, like company recognition and lack of training budgets.”

This level of research helps you dial in on who to survey — in this case, surveying administrative staff, not people management teams.

5. Avoid asking biased or double-barreled questions

Subjective questions lead participants in one direction, skewing the results. For instance, “Don’t you think our product is the best?” is a leading question.

Alternatively, asking a double-barreled question confuses respondents and leads to unclear responses, especially if it’s qualitative. For instance, “How satisfied are you with our product’s price and quality?” tries to answer two questions in one.

6. People love data, but you need to stitch it into a story

Raw data, while valuable, often comes across as sterile and disconnected. Use data storytelling to weave that data into a cohesive, engaging narrative that entices your audience.

Use data to tell a compelling story that captures attention, provides context, and leaves a lasting impact. It’s about balancing logic (data) and emotion (story) to drive the message home.

Katherine Boyarsky, co-founder and CMO at CXD Studio, a content marketing agency, recommends presenting key findings first and deep diving after:

“Frame the report with key findings up front, where readers can quickly skim the most insightful data points and themes,” says Boyarsky. “Give each chapter or section a theme and organize the data starting with benchmarks, then getting into how people are overcoming challenges, what the solutions are, and ways they can look to the future and prepare for what’s to come.”

An example of how you can present key findings from your report before diving deeper into them

7. Focus on one problem at a time

Investing significant resources into your content may tempt you to address multiple issues at once. Resist that urge.

A narrow focus sharpens your content, making it easier for your audience to digest and act on the core message. Think of your survey-based content as a topic cluster. Each piece dives into a different facet of the main issue, providing a more nuanced understanding.

For example, when Algolia published the Ecommerce Site Search Trends in 2023 report, every question in their survey revolved around site-search products. This consistency helped the audience better understand the subject but also subtly showcased Algolia’s own site-search product. By staying on topic, Algolia delivered a report that was both memorable and actionable.

8. Build a story tracker from your report findings

In an article for CMI, Linn suggests using a story tracker to catalog and organize potential content ideas stemming from your research. Once your research is complete, each data point, insight, and potential narrative can become a valuable content asset. You have two options: brainstorm new topics or angles based on your findings or refresh existing content with your latest statistics.

This approach rejuvenates your current content and provides a solid foundation for an entire campaign built around your report.

An idea tracker template built in Airtable to brainstorm topics and content angles from your report. Source

9. Explore multiple avenues for creating reports

You don’t always have to partner with a third-party provider to publish something unique. Tap into internal data or use low-lift methods to gather data.

Some options include:

-

Use in-app product data to understand how customers use your product

-

Conduct qualitative interviews with your audience

-

Do a comparative analysis of historical data

-

Use short surveys to ask pointed questions about a narrow topic of interest

-

Analyze data from third-party sources

-

Use internal market or audience research documents to find interesting data points

For example, Boyarsky’s team at CXD Studio helps Doordash, an online food delivery platform, conduct the DoorDash Restaurant Online Ordering Trends report annually. They use past reports and current survey data to compare and highlight key trends.

Customer data from 2021 and 2022 showed that 6% of readers joined the platform after reading the report. That’s 1,500 new customers attributed to a single report.

10. Hire a dedicated data analyst for your program

A research-led content program is only as good as the insights derived from the data. While collecting data is the first step, the real magic lies in interpreting and translating that data into actionable insights.

You need someone to collect, organize, and analyze the data. Sirkin recommends hiring a data analyst with a strong business understanding:

“Many companies have a generalized analytics team or department supporting different business functions, so they don’t know what any of it is,” says Sirkin. “But if you have a dedicated marketing analyst or marketing analytics team, you can educate them on the data they’re analyzing.”

This approach empowers the analyst to create a report incorporating the company’s narrative. Also, it makes it easier for the analyst to educate internal team members while presenting the findings.

11. Integrate distribution to extend content reach

Only 6% of B2B content marketers amplify their research findings. It’s a waste of data, considering how much effort goes into producing a research report. Think about distribution from the planning stages to maximize your content mileage.

For instance, the marketing team at Databox, a business analytics platform, discusses the latest survey results on their podcasts while offering suggestions.

Here are a few ways to bake distribution into the process:

-

Share your findings on social media

-

Build a series of blog posts around the topic

-

Ask experts to share the content on their social media or newsletter

-

Work with influencers to reach a broader audience

-

Create one-pager documents for sales enablement and product teams

-

Ask your research partners to share it in their marketing channels

-

Create a video series where experts share their thoughts on the results

12. Future-proof your process with solid documentation

Documentation isn’t paperwork; it’s your playbook for success. Otika at Office Otter discovered this when they dived into their first research report without a roadmap:

“A specific challenge we had was a lack of a documented process because we had never created a research report before,” says Otika. “We made many mistakes, and at the end of the project, we sat down and looked at our process to understand what we could change.”

“For example, we didn’t outsource graphic design, which could have freed up time to create content and distribute it before we published the second report.”

The lesson? Document each step for future reports. It’s a set of guidelines that empower everyone involved to act more efficiently. By documenting the process, you avoid pitfalls and establish a sustainable program for long-term gains.

Original research doesn’t have to be a massive investment

Boyarsky says it’s a myth that research-driven reports are too expensive.

“Anyone can publish research-driven reports, no matter your size, stage, or budget,” says Boyarsky. “You can write a 10- or 20-question survey and share the link on social media or with your audience via email. Once you have enough responses to be meaningful, create the report.”

She also recommends partnering with other brands to pool resources or acquire an audience from Pollfish or SurveyMonkey Audience.

That’s precisely how Databox built its survey and contributor program internally. When Peter Caputa, Databox’s CEO, joined the company in 2017, they barely did any marketing. And because the product was integration-based, he realized there were only a few topics his team could speak on with authority.

This resulted in a contributor program where they sent short questionnaires to people within their network, organized the results in common themes, and published them. Contributors were happy to be featured with a backlink, while Databox built a repository of valuable content with zero assumptions over time.

“When we started, it was one-on-one, and the benefit was we were going to quote them,” says Caputa. “People appreciate that because they aren’t receiving outreach that says, ‘Hey, I want to feature your expertise in my content.’ Most people receive outreaches like, ‘Hey, buy my product, or check out my content.’ So by reversing it, it helps because it’s a compliment.”

As a result of this approach, Databox’s website achieved a high Domain Authority. Over time, it helped the company rank for relevant high-intent keywords that brought in product sign-ups.

As of October 2023, Databox has 343,000+ backlinks from 14,800+ unique domains as a result of a survey-led approach

Rise above the noise with proprietary research

In a market saturated with AI-generated content, originality is necessary. Publishing proprietary research reports gives you the data points to support internal activities and become an authority in your industry.

Start small if you have a limited budget. Consider setting up contributor programs that are cost-effective and rich in value.

Use the information above to design a focused research program. Then, turn your data into compelling stories and use diverse distribution channels to amplify your reach. The payoff is multifold — establishing you as an industry leader in the long run.

0 comments:

No comments found.